Starting an Limited Liability Company in the Treasure State can appear overwhelming, but if you use the proper method, you can set things up smoothly and circumvent common pitfalls. You’ll need to be aware of some critical actions such as picking a strong company title and confirming state rules are met. If you want to shield your company and ensure compliance from day one, it’s critical to get the basics right—let’s unpack exactly what you need to know next.

Selecting a Company Name for Your Montana LLC

A powerful entity title creates the platform for your Big Sky Country LLC. You’ll want a identity that’s stands out, brandable, and mirrors your company values.

Start by checking Montana’s business name database to make sure your desired name isn’t duplicated or likely to cause confusion. Your chosen title is required to have “Limited Liability Company,” “LLC,” or “L.L.C.”

Don’t include restricted words like “bank” or “insurance” unless eligible. If you find the perfect name but aren’t ready to form the LLC, you can put it on hold for one-third of a year by submitting the application and paying a fee.

Naming a Resident Agent in Montana

Every Montana LLC is obligated to name a statutory agent to receive service of process and compliance paperwork on your behalf.

Your registered agent must have a physical address in Montana, distinct from a postal box, and must be present during Monday–Friday, 9 to 5.

You can choose your own resident agent, designate someone you trust, or hire a professional service.

Just ensure your agent is trustworthy and always accessible, since unreceived documents can result in legal trouble or future headaches.

Double-check that your chosen agent meets all state rules before listing them in your registration papers, maintaining compliance.

Processing Articles of Organization With the Government

Launch your Montana LLC by completing the Articles of Organization with the State office. This is a key step that makes legal your entity.

You’ll submit this filing electronically through the Montana’s Business Services system. List your LLC’s name, office headquarters, registered agent details, and your LLC’s purpose.

Check that your business name is available and meets state requirements. The filing fee is $35, payable by credit card.

Once processed, you’ll receive a certificate confirming your LLC exists. Keep this this document, as you’ll need it for financial matters.

Drafting an LLC Operating Document

Although Montana does not mandate LLCs to have an operating agreement, it’s wise to write one to preserve your LLC structure.

An operating agreement details each member’s roles, ownership percentages, and management duties. You’ll also create rules for voting, allocating gains, and how to manage conflicts among members. If you ever hit a conflict, this document will serve as your rulebook.

Even if you're a single-member LLC, an operating agreement improves your business profile and helps maintain legal separation.

Review and revise this document as your company changes as your business grows or as ownership shifts.

Fulfilling Annual Regulatory and State Tax Requirements

As you conduct business with your Montana LLC, it's important to stay compliant with continuous regulatory and IRS obligations.

You’ll need to meet your annual reporting duty with the Secretary of State by April 15th annually and cover state fees.

Keep your listed agent info accurate and maintain accurate business records.

If you employ people or sell products taxed by Montana, register with the Department of Revenue and pay promptly.

Don’t forget to separate your business finances from personal accounts.

Monitoring these requirements helps your LLC maintain good standing and lowers the chances of punitive action or loss of your LLC status.

Conclusion

Creating an LLC in Montana is straightforward when you follow these steps. First, register an original name, then choose a representative, file the Articles of Organization, and write (or adapt) your operating agreement. Don’t forget to keep up of annual reports and tax filings to protect your LLC’s existence. With these moves, you’ll have a firm start for your venture and clarity as you visit the website embark on your journey.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Jeremy Miller Then & Now!

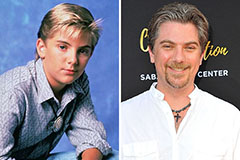

Jeremy Miller Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!